What DIY Retirement Plans Often Miss (And Why It Matters)

Many people like to handle their own retirement planning. After all, choosing investments and managing your savings feels empowering. But there’s more to retirement planning

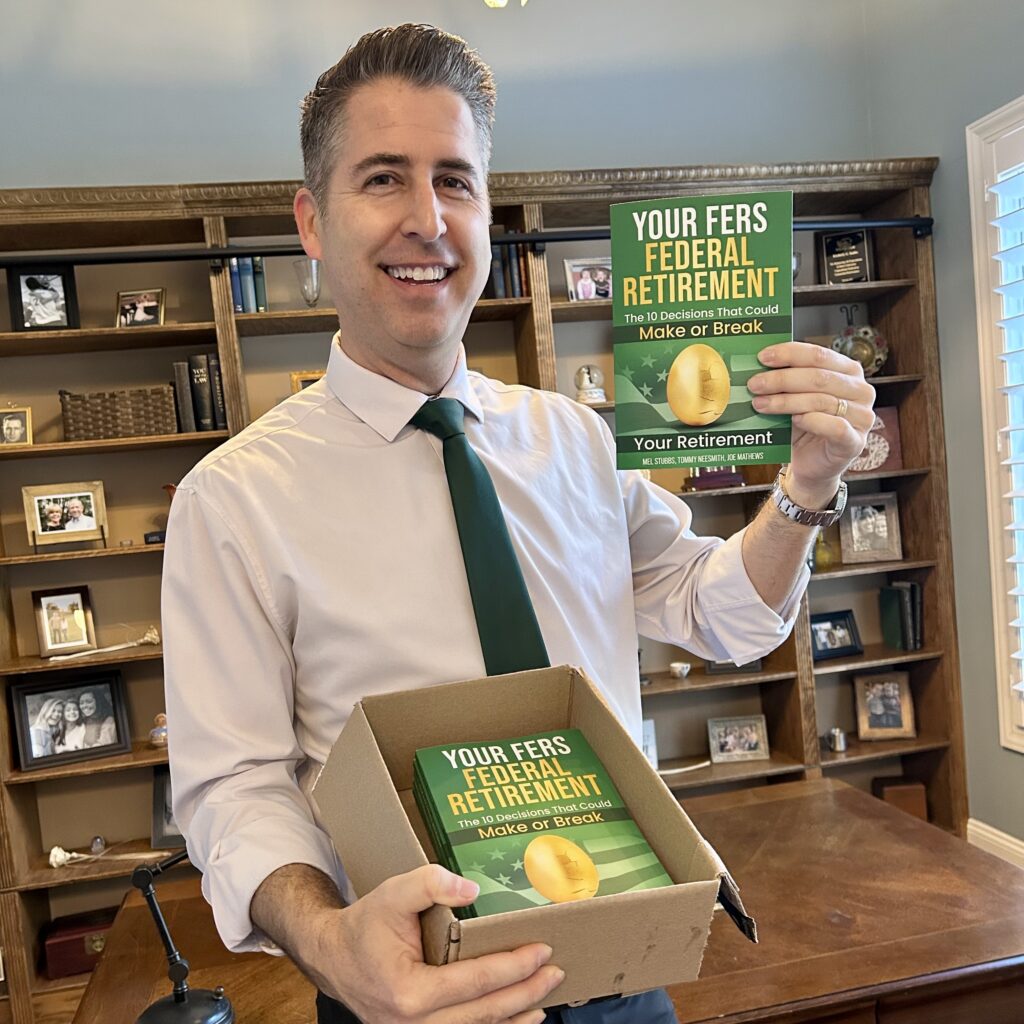

For most people, planning for retirement raises a ton of questions. Retiring as a federal employee is even more complex! How do you manage your TSP, FEGLI, FEHB…? Not to mention tax planning, social security, and survivor benefits? The list of questions to address goes on and on.

With each question comes a decision, and those decisions will have lasting implications. So, how do you make the best decisions for you? That’s what this book is all about.

There are 10 key decisions that must be made at your federal retirement. If those decisions are made well, you’ll embrace your retirement with confidence and purpose. If made poorly, they can lead to decades of unnecessary worry and anxiety.

This is a good first step as you develop

your plan for federal retirement.

We host monthly educational webinars on

retirement topics for federal employees.

We have a growing library of articles

and videos for your education.

For Federal Employees

Many people like to handle their own retirement planning. After all, choosing investments and managing your savings feels empowering. But there’s more to retirement planning

If you’ve ever wondered when the right time to make a Roth conversion is, you’re not alone. At Christy Capital Management, we work with federal

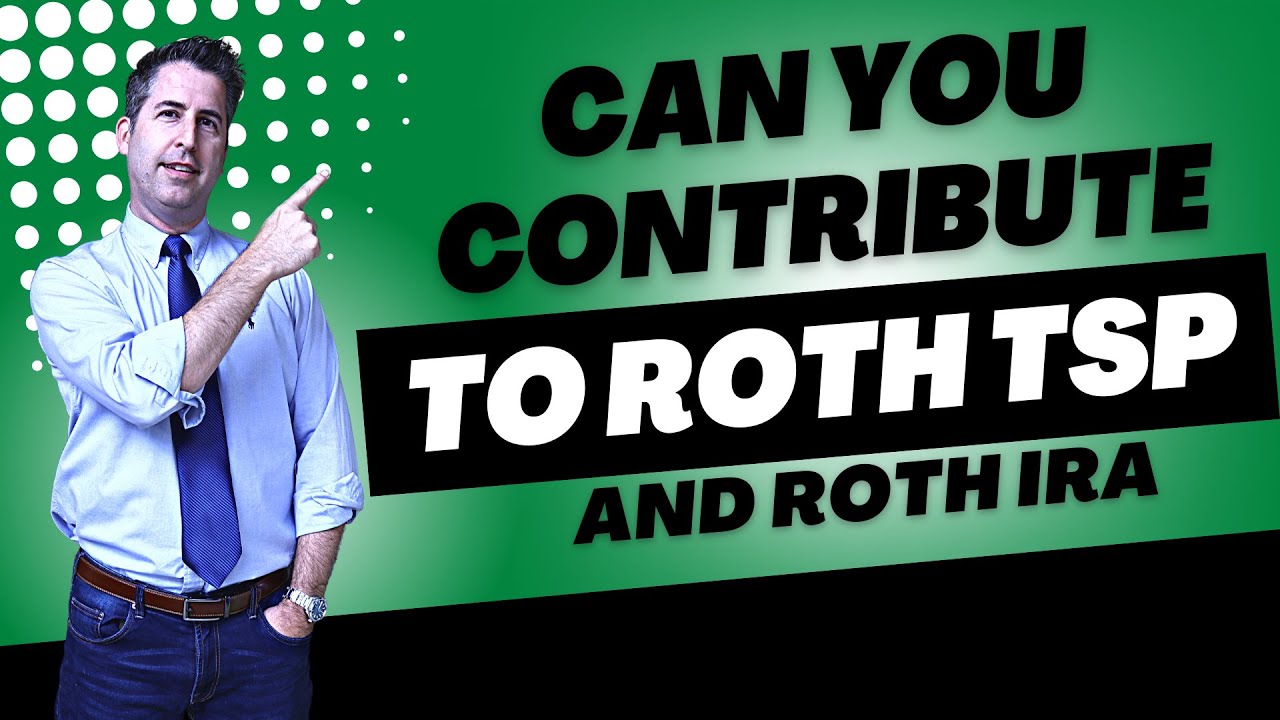

Here’s a question most people don’t ask (but more should be thinking about): Should I be investing in my Roth IRA differently than my traditional

Is there a chance the government might decide to change all the rules when it comes to Roth–and throw taxpayers a nasty, expensive curve ball?

Let’s talk about those “required minimum distributions” (RMDs) that the IRS makes retirees take from their traditional TSPs or IRAs. At Christy Capital Management, we

If you want to cut your taxes now, there are multiple ways to do it. You can contribute to a traditional retirement account or put

Your next chapter shouldn’t feel like a big mystery. And it shouldn’t be a source of anxiety or dread.

You need a financial advisor team you can trust… and a plan that leads to a meaningful future. Imagine using your wealth in a way that aligns with your deepest values and makes life better for others. Imagine how great it would feel to finish well.

Sound good? Then stop imagining and take the practical first step toward a meaningful future.

Working together, we’ll tailor a plan that reflects your deepest beliefs and biggest hopes. Then we’ll implement that plan, carefully monitoring it, and making necessary corrections along the way.

You’ll navigate retirement with the confidence that you have enough. Even better, you’ll have a clear purpose and be positioned to invest in the causes that matter most to you.

In unpredictable times and with constantly changing laws, converting retirement savings into regular retirement income can be confusing. Instead, be confident knowing what assets you need.

Most people fret about retirement. As a fiduciary financial advisor, our clients enjoy peace-of-mind knowing they’ll have the assets they need for the next chapter of life.

The best retirement isn’t “from” work. It’s “to” new challenges! We help our clients strategize ways to invest their resources in the things that matter most.

Advisory services offered through Christy Capital Management, Inc., a Registered Investment Advisor.

All rights reserved © 2012-2024 Christy Capital Management.

Delivered right to your inbox.

No junk. Only helpful resources. Unsubscribe at any time.