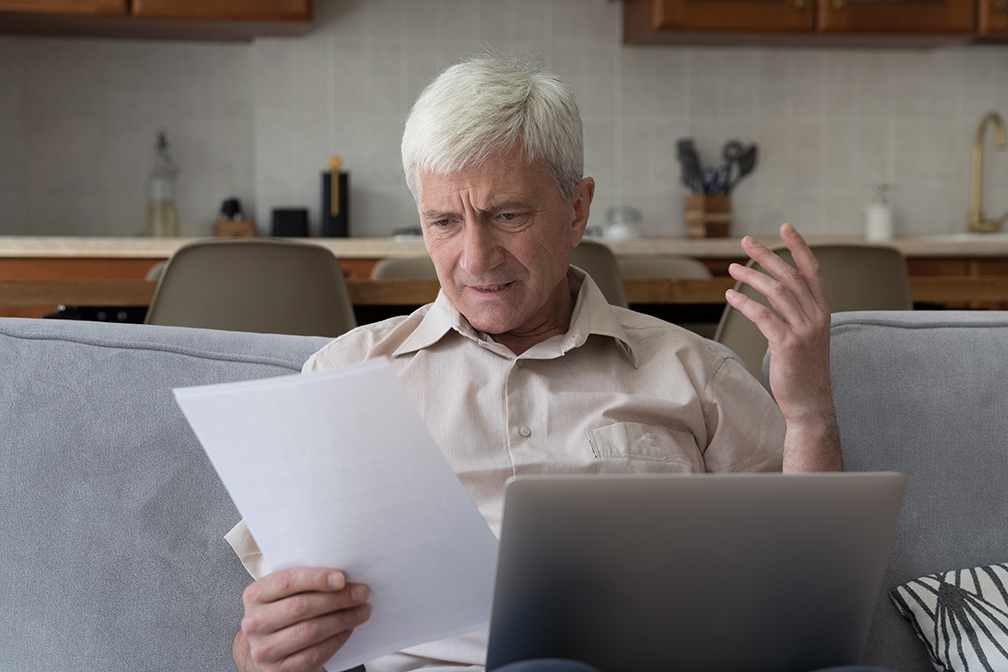

Many people like to handle their own retirement planning. After all, choosing investments and managing your savings feels empowering. But there’s more to retirement planning than investment selection alone.

DIY planners can overlook crucial elements, especially advanced tax planning strategies, that can make a significant difference over time.

At Christy Capital Management, we often work with federal employees who’ve done a commendable job saving for retirement. Their plans aren’t likely to fail, but without careful planning, they may inadvertently pay thousands more in taxes than necessary.

Here are several common areas that DIY retirement plans frequently miss:

1. Advanced Tax Planning Strategies

Tax planning is a major piece of a successful retirement plan. But DIY planners often don’t stay updated with nuanced tax changes or proactive strategies.

Consider the example below:

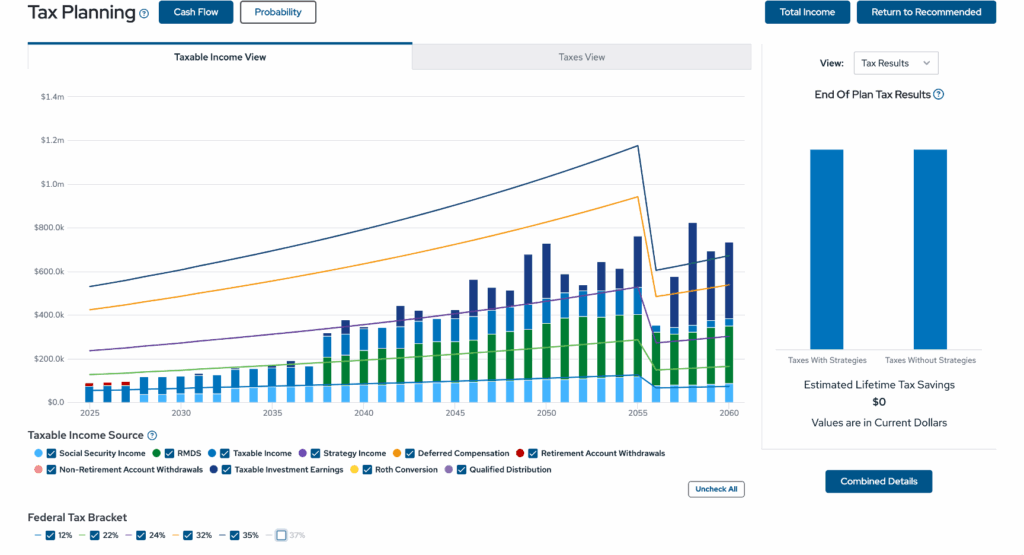

Before tax planning:

Income remains manageable until Required Minimum Distributions (RMDs) begin. Afterward, income jumps dramatically, pushing retirees into higher tax brackets and increasing tax obligations significantly.

© MoneyGuide, Inc. Reproduced with permission. All rights reserved.

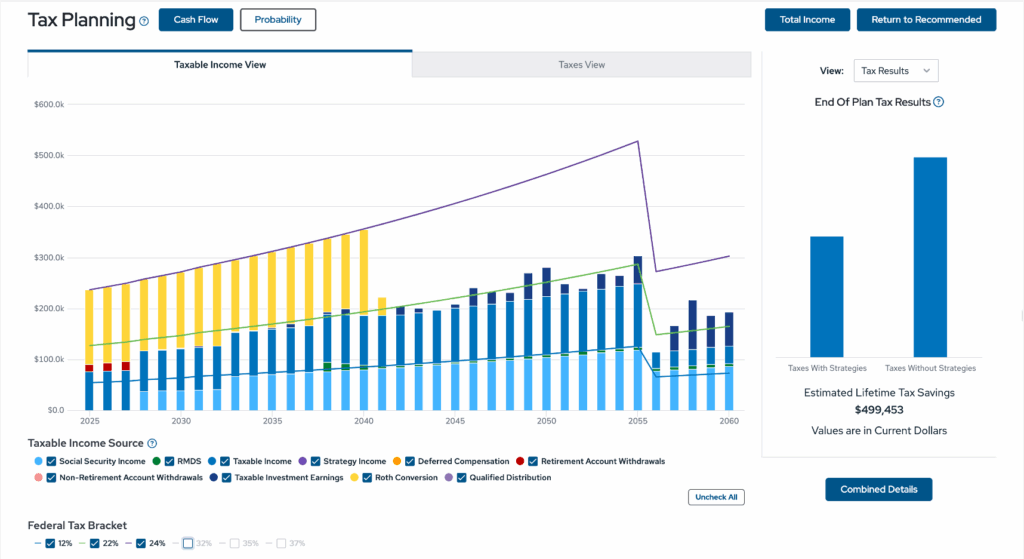

After tax planning (Roth conversions):

Implementing strategic Roth conversions earlier in retirement can help smooth taxable income, reducing lifetime taxes substantially. In one scenario, this strategy helped a couple potentially save around $499,000 over their lifetime.

© MoneyGuide, Inc. Reproduced with permission. All rights reserved.

Tax planning doesn’t just impact taxes. It can enhance how much you have to spend or leave to heirs.

2. Proper Delegation

Delegation frees up your time and can reduce stress significantly. Consider this: Would you trust your retirement plan to an advisor whose only experience is managing their own investments? Probably not.

Yet, DIY planners often put themselves in this exact position.

Delegating retirement planning tasks to experienced professionals can provide peace of mind, allowing you to enjoy your retirement more fully.

3. Protecting Your Spouse and Family

DIY plans often depend heavily on one spouse. But what happens if something happens occurs to the spouse managing the finances?

A professional advisor can assist your surviving spouse, guiding them on:

- Tax-efficient distributions

- Proper income management

- Investment strategies to maintain financial stability

Ensuring your spouse is supported can be an invaluable benefit of professional planning.

Final Thoughts

While managing your retirement can be rewarding, it’s wise to acknowledge areas where professional assistance might add significant value.

The complexities of federal retirement, in particular, require detailed knowledge and regular updating—something many DIY planners don’t have time to maintain.

If you’d like assistance reviewing or building your retirement strategy, especially as a federal employee, reach out to us.

You can use the “Talk with an Advisor” button here on our website, and we’ll follow up to find a time to connect.

Retirement is too important to leave to chance.