Most people want to be retired. But wanting to be retired and actually being ready for retirement are two very different things.

At Christy Capital, we believe retirement is only ideal when people are both emotionally and financially prepared.

Let’s look at those two factors.

1) How do you know if you’re emotionally ready for retirement?

First, to be emotionally ready for retirement, you need a clear sense of who you are.

This is the question of identity.

Unfortunately, in our culture today, we tend to define ourselves by our jobs. What’s the first thing we say to people we meet? After swapping names, we usually mention what we do for a living.

In retirement, that identity–which is tied to our long-term career or former job–is stripped away. You’re no longer a high school math teacher or a bank vice president or a pharmaceutical salesperson. You were that, but not anymore.

Obviously, you still have an identity. You’re a spouse perhaps, or maybe a parent or grandparent. But the loss of your occupational identity can make you feel lost.

This unsettling feeling underscores the importance of creating a new identity.

- Who or what do you want to be now?

- The world’s best grandparent?

- A faithful friend?

- An RV vagabond?

- A helpful neighbor?

- A hobbyist?

In retirement, you get to reinvent yourself! That’s one of the key benefits. The process can be a little unnerving at first, but it can also be a source of tremendous joy.

The second thing you need to be emotionally ready for retirement is a clear sense of what you’re going to do.

This is the question of activity.

Again, if you know who you want to be, it’s a lot easier to figure out what you should be doing.

Still, this is tricky for many. They think of retirement as simply walking away from a job. It is that, but it’s also stepping into a brand new chapter in life.

Think about it like this: For 30 or maybe 40 years you’ve basically had an employer provide you with daily structure.

With the exception of time off, your life and schedule were pretty much set week after week, month after month, year after year. Even when you changed jobs, your new employer stepped in and provided you a job description, perhaps even a set of “career tracks” to run down.

But when you get to retirement, you’re not handed any sort of structure like that. For some, the freedom is exhilarating. For others, it’s disorienting, even debilitating.

To be ready emotionally for retirement, you need a clear and specific plan. People with vague ideas about retirement often have trouble adjusting. They get restless. Often they end up depressed or at least disillusioned.

The good news? You don’t have to experience such unpleasant emotions.

Once you know who you want to be, you can create a retirement plan (i.e., by thinking through exactly what you’d like to do).

That’s how you turn what’s often a hard transition into a smooth and enjoyable one.

By the way, the list of possible activities is practically endless:

- Volunteering

- Learning a language

- Joining a civic or social club

- Reading/participating in a book club

- Traveling

- Running for office

- Taking a class

- Spending time with kids/grandkids

- Pursuing hobbies

- Learning new skills

- Getting fit

- Mentoring younger people

- Going on mission trips

- Serving at your church

- Getting a part-time job (doing something you’d actually be willing to do for free)

In summary, to be ready emotionally for retirement, you need to have a sense of who you are and what you’ll do.

Now …

2) How do you know if you’re financially ready for retirement?

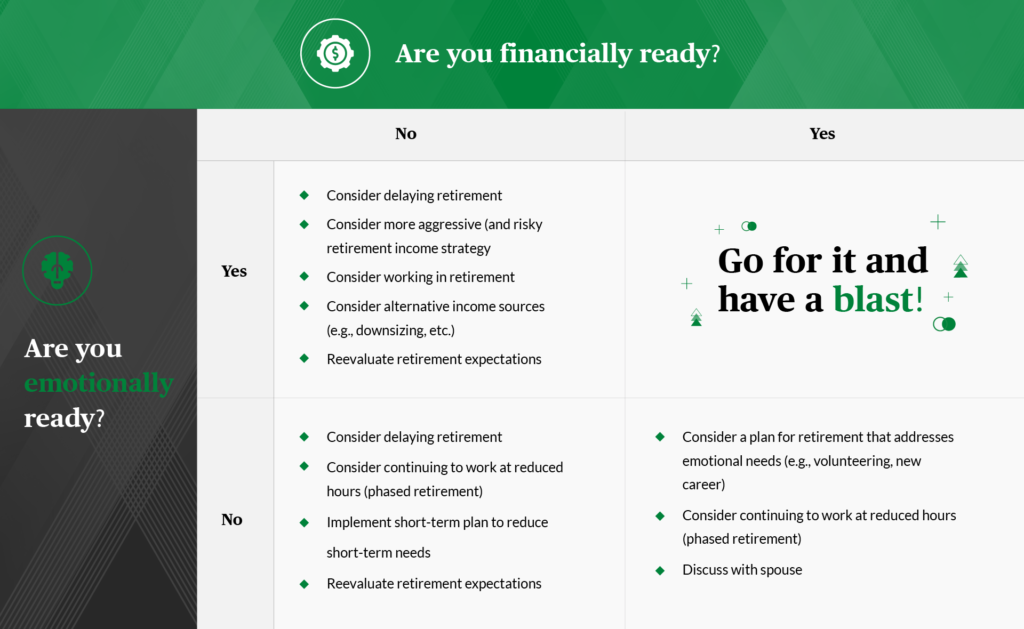

Let’s answer this question with a simple chart. Here you can see the four possible answers to the two big retirement questions: Are you emotionally ready? Are you financially ready?

As you can see, answering these two questions about emotional and financial readiness can get complicated.

If you don’t have two “yes”es to those questions, you’ve got work to do!

That’s why it’s always wise to seek wise, unbiased counsel. For the emotional part, you may wish to talk to your priest, pastor, or rabbi. Or you might consult a counselor if the mere thought of leaving your job is making you miserable.

For the financial part, you’ll want a retirement specialist who can look at your situation, and help you figure out your best options.

If you’ve got a financial planner you trust, don’t hesitate to schedule an appointment. Do it this week. These matters are much too important to put off.

If you don’t have a financial advisor, let me encourage you to contact us at Christy Capital Management. Our team includes CPAs and experienced planners. We’ve helped hundreds of others plan for and then enjoy their retirements.

We can help you too.

Call us at 866-331-7749. We’ll help you get ready–emotionally and financially–for a meaningful next chapter!